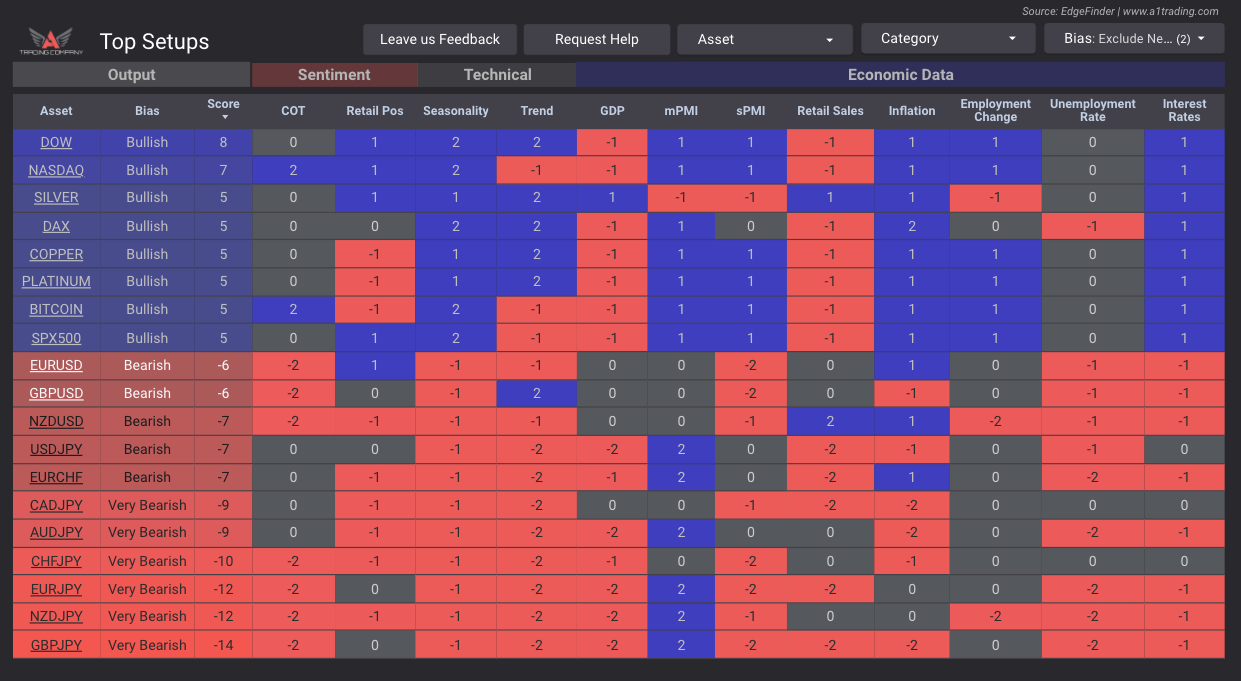

Here’s the full breakdown of my $17,000 silver trade—why I entered, how I managed it, and what’s driving silver.

Here’s the full breakdown of my $17,000 silver trade—why I entered, how I managed it, and what’s driving silver.

In one of his most successful trades of the year so far, Nick capitalized on a major breakout in the Russell 2000 (US2000) index, driven by a combination of macroeconomic shifts and well-timed entries. Let’s break down the trade, the reasoning behind it, and how Nick managed it with a professional trailing stop strategy. The […]

Discover how Nick locked in three profitable forex trades this week—and the strategies behind each win.