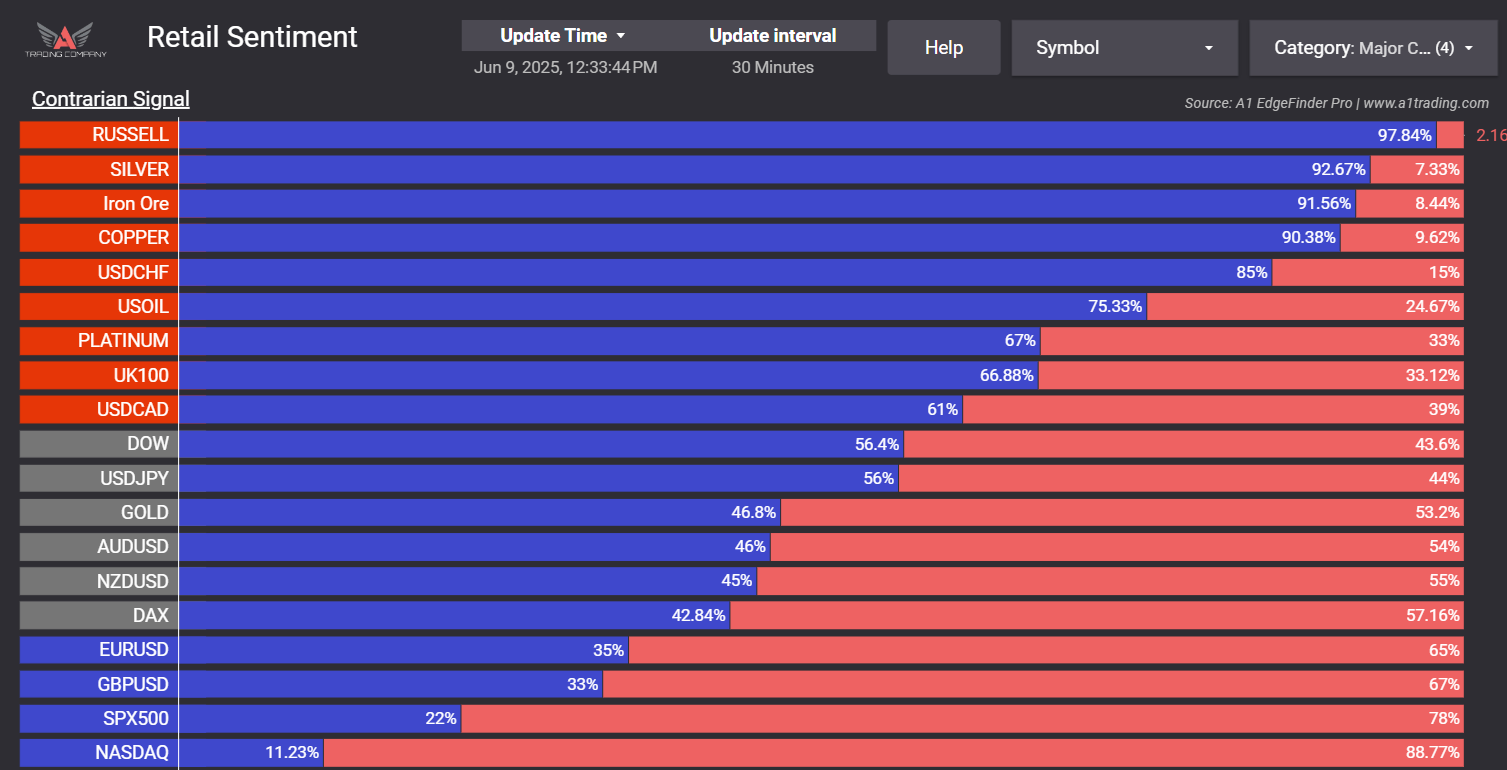

Contrarian Signal Thresholds:

When retail positioning for an asset is above or below 60% (meaning 60% or more of retail traders are either long or short), it triggers a contrarian signal. If retail traders are 60% or more short on an asset, the EdgeFinder highlights a bullish contrarian setup, signaling that the asset might rise. Conversely, if retail traders are 60% or more long, it signals a bearish contrarian setup, suggesting potential downside.