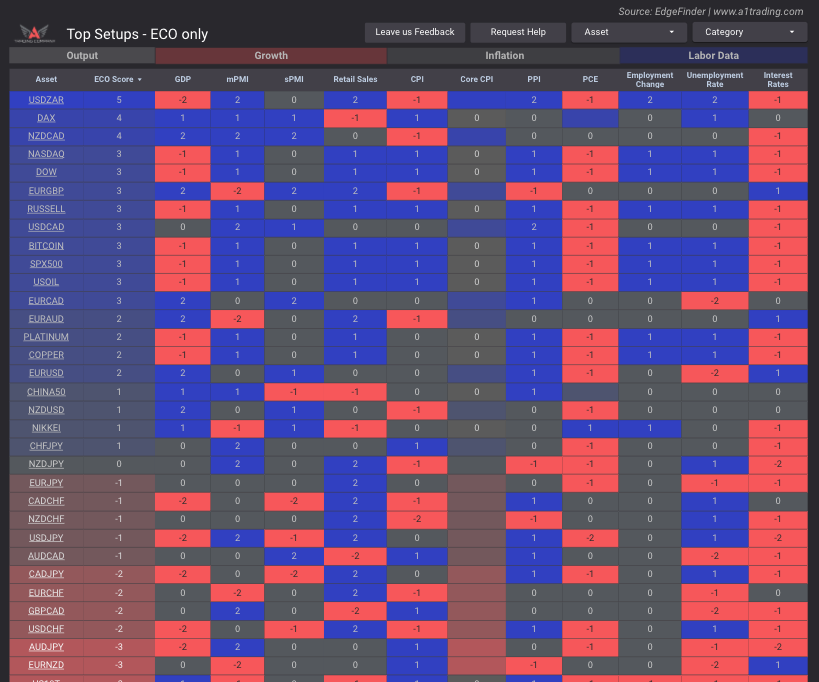

Indices:

S&P500, Dow Jones, Nasdaq, DAX, Nikkei, FTSE100

Metals:

GOLD, SILVER, PLATINUM, COPPER

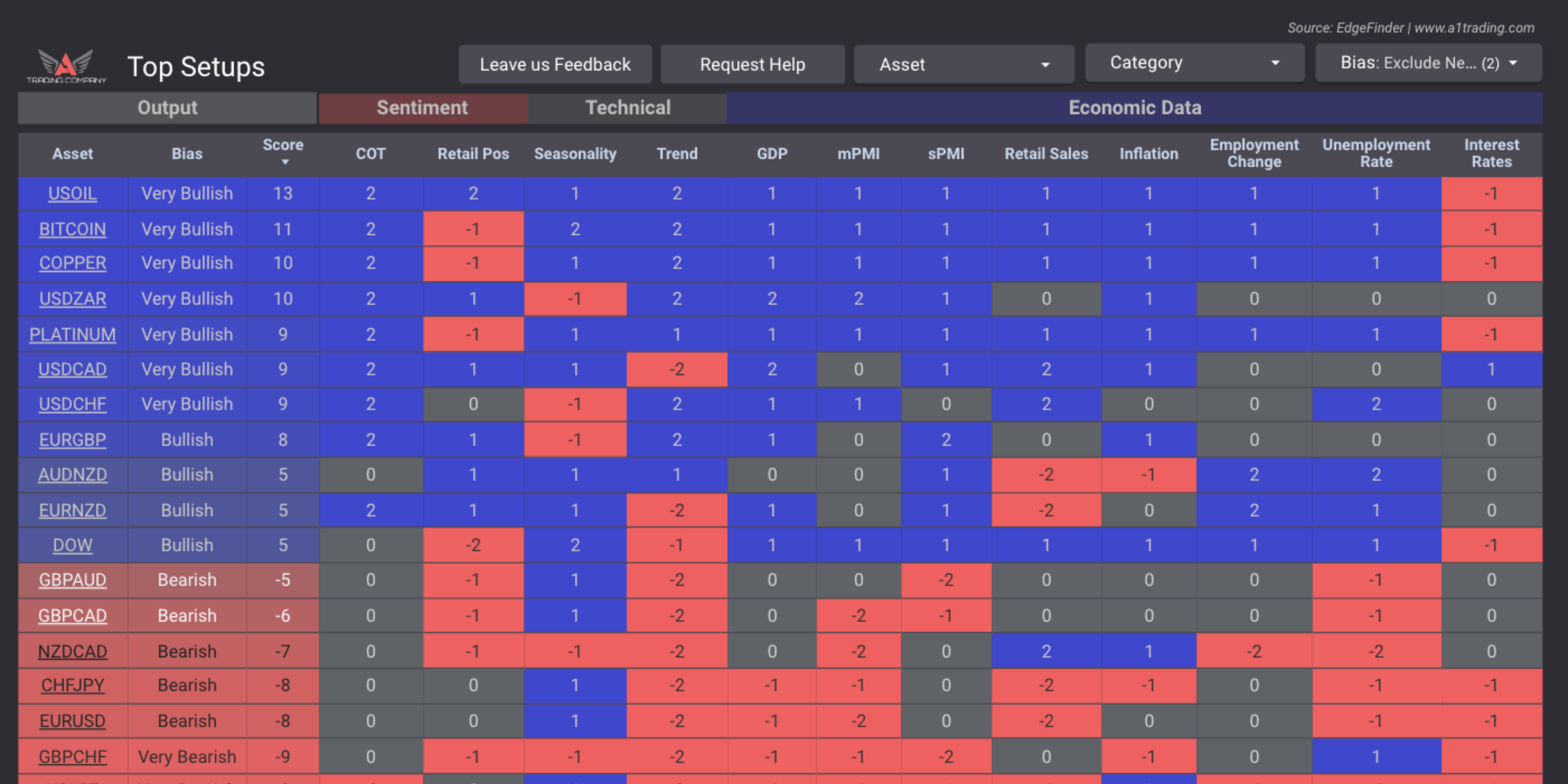

Forex Major Pairs:

AUDUSD, NZDUSD, USDZAR, GBPUSD, USDJPY, USDCAD, USDCHF, EURUSD

Forex Minor Pairs:

AUDCAD, AUDCHF, AUDJPY, AUDNZD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNZD, NZDCAD, NZDCHF, NZDJPY

Energy:

USOIL

Bonds:

US Treasuries