S&P 500 holds near highs, but Fed cuts could spark short-term volatility before medium-term bullish momentum resumes.

Silver has been on the move recently, and I want to walk you through one of my biggest trades on this metal—currently up around $17,000. More importantly, I’ll explain the process that led me into the trade, how I’ve managed it along the way, and the key factors driving silver’s price higher.

From a technical perspective, silver had a very strong breakout on the spot chart. To identify potential entry levels, I used Fibonacci retracement levels.

This trailing stop approach means I’ll stay in the trade as long as the uptrend remains intact, but if price breaks down and fails to hold support, I’ll exit with profits.

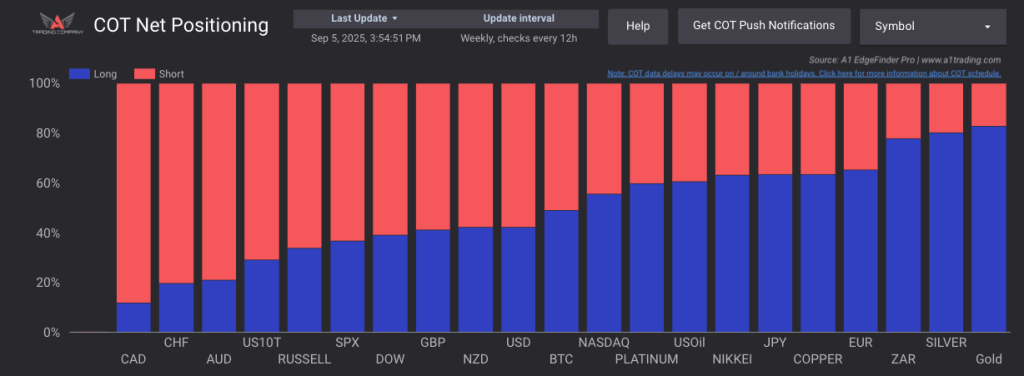

Beyond chart patterns, sentiment data has also been very supportive of silver. The latest Commitment of Traders (COT) report showed institutions buying aggressively:

When institutional traders increase their exposure in this way, it’s often a strong sign of continued momentum.

Finally, the fundamentals provide the bigger-picture reason why silver (and gold) have been in demand.

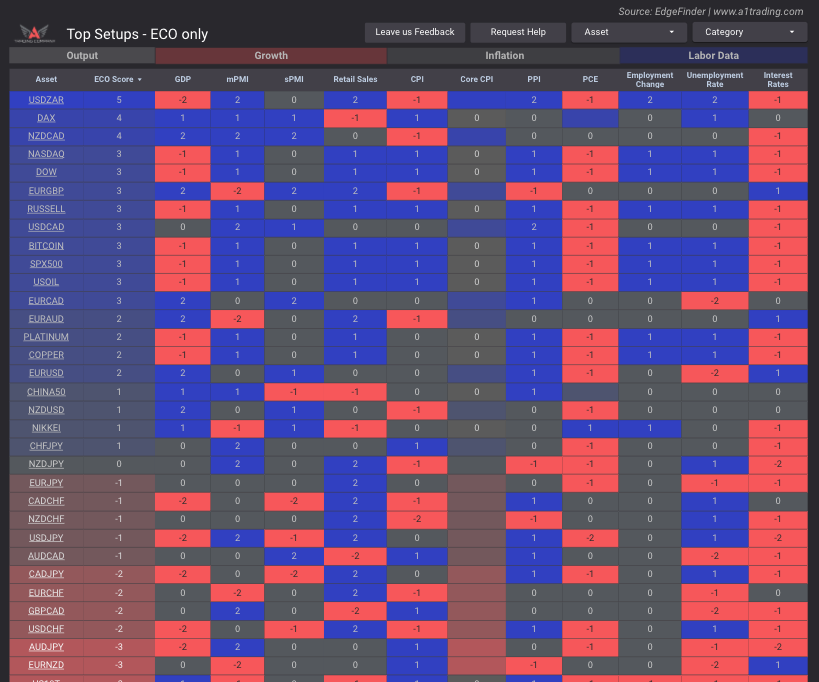

These conditions line up perfectly with what we’ve been seeing in the EdgeFinder: consistently bullish scores for both gold and silver based on sentiment, trend strength, and economic data.

This trade is a good example of how I combine multiple factors into my decision-making process:

For me, the plan is simple: trail my stop as price continues to form higher lows and higher highs on the 4 hour chart, which is the timeframe I used to enter the trade. If price breaks down, I’ll step out and take the profit.

S&P 500 holds near highs, but Fed cuts could spark short-term volatility before medium-term bullish momentum resumes.

DXY holds near support as traders await FOMC, with three cuts priced and data setting the next move.

Sterling stalls at resistance as soft UK growth data shifts attention to next week’s BoE meeting and balance sheet risks.