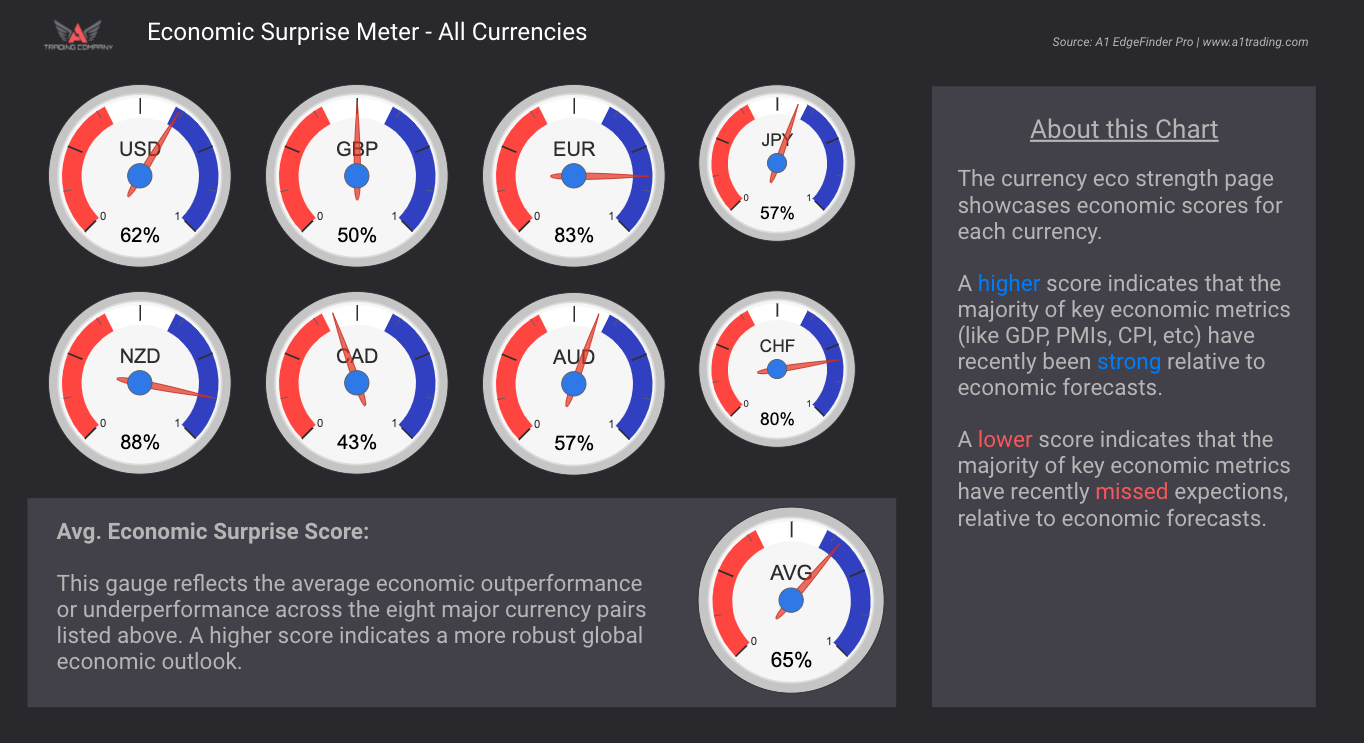

The Economic Surprise Meter builds on the heatmap by converting all those data surprises into scored gauges—one for each of the 8 major currencies:

USD, EUR, GBP, JPY, CHF, AUD, CAD, NZD

Each gauge shows a 0–100 score based on how well recent economic data is performing relative to expectations. It’s not just about whether GDP, inflation, or jobs data improved—but whether it beat or missed forecasts.