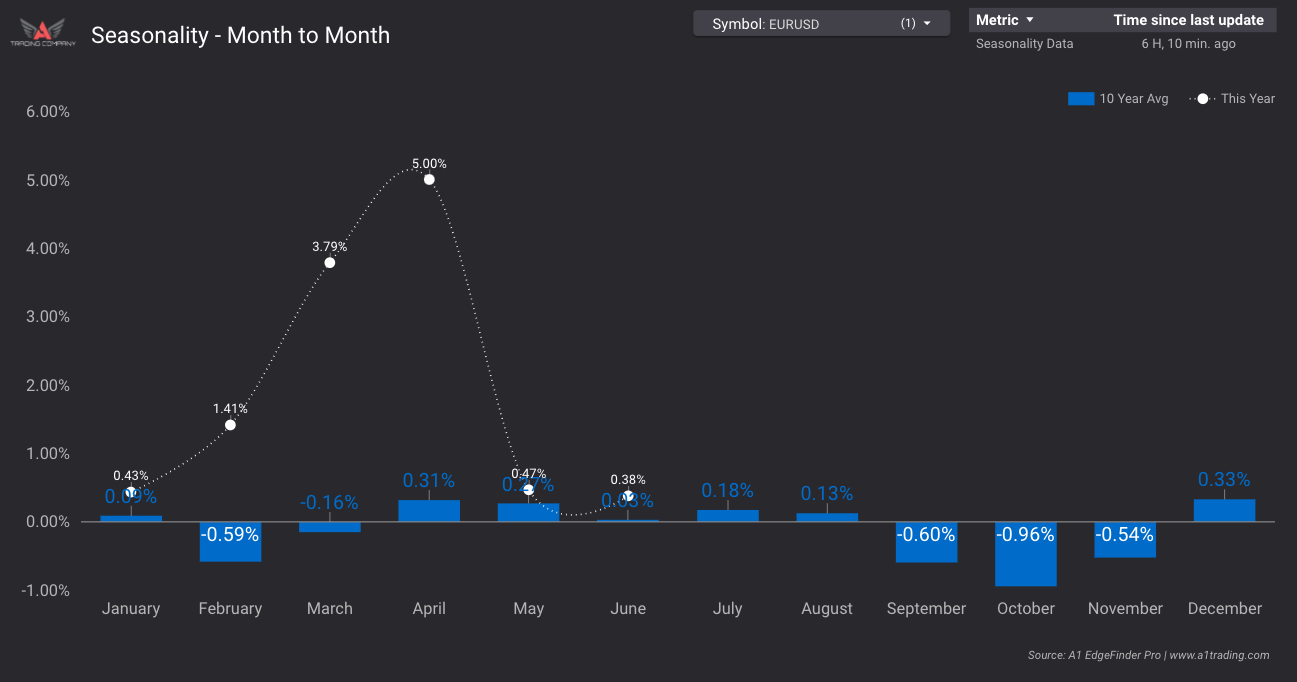

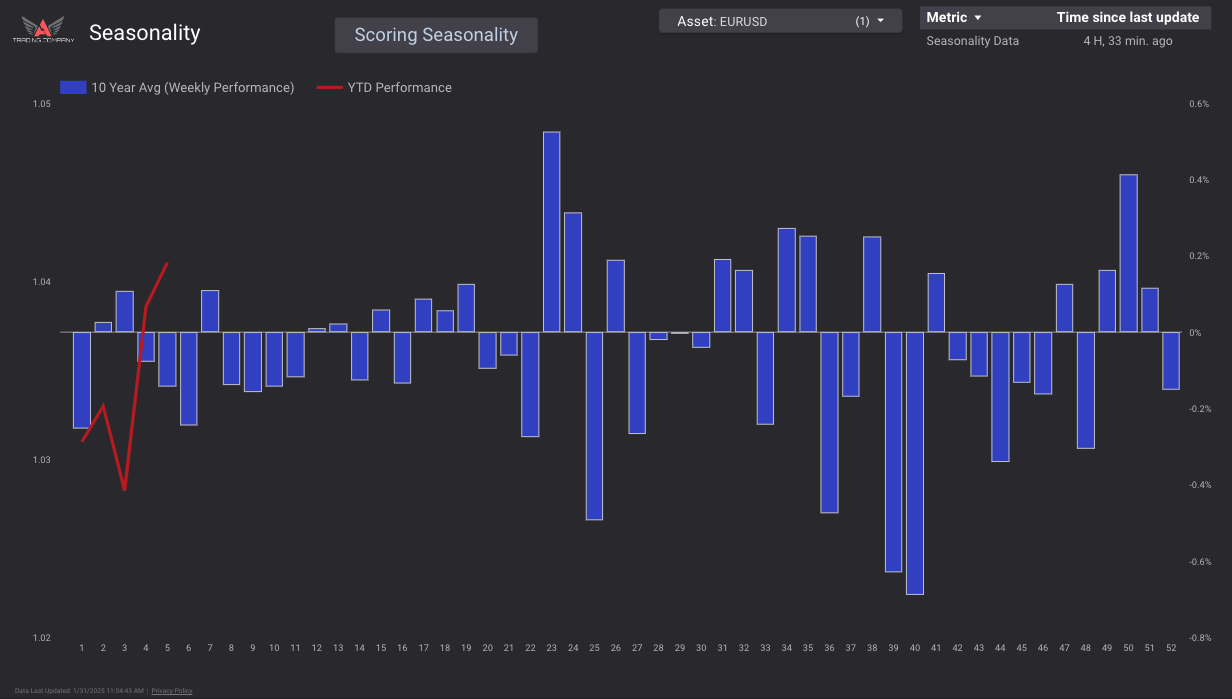

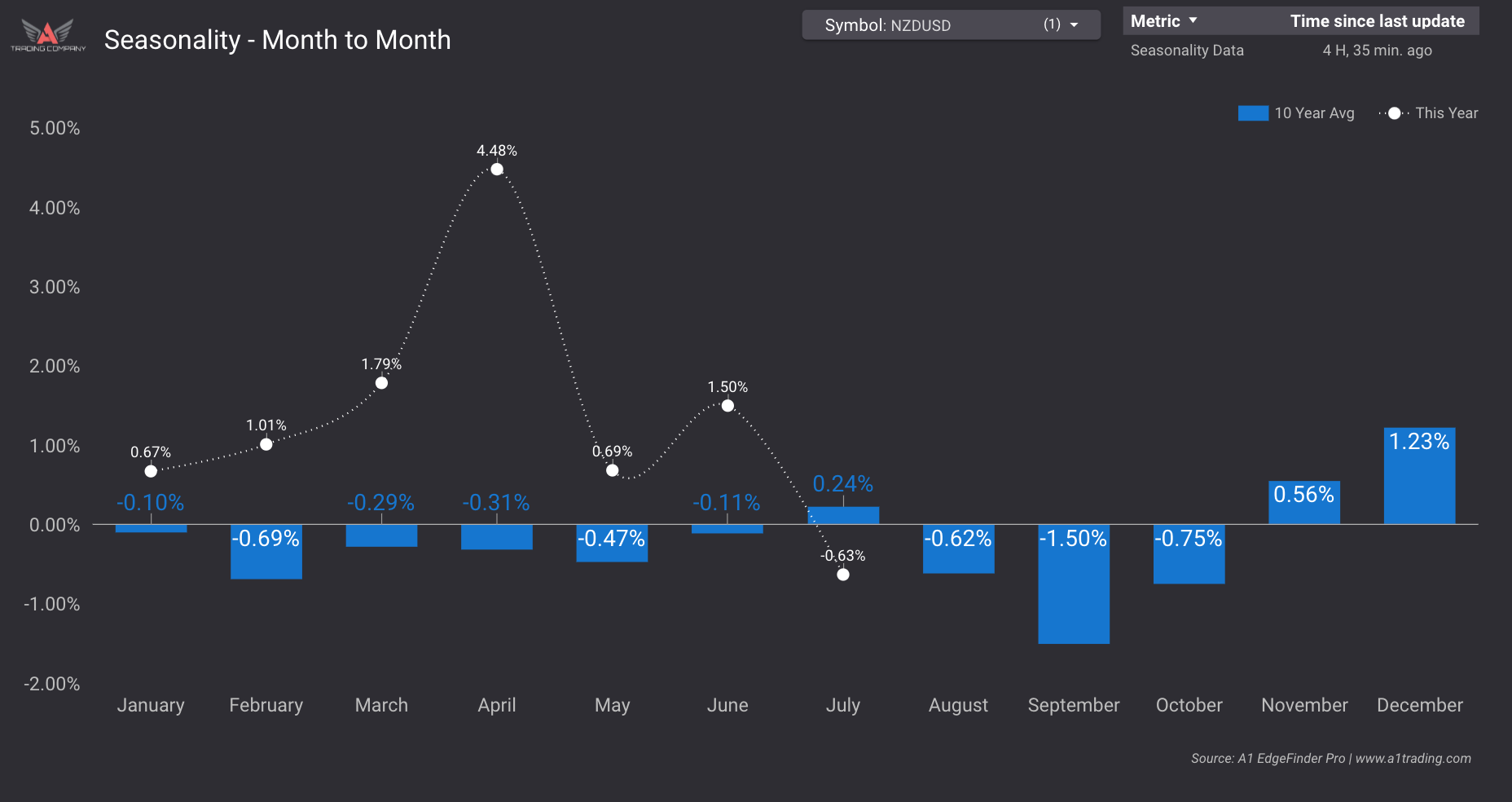

The Seasonality Score leverages historical data to highlight average monthly and weekly performance trends, helping traders make informed decisions based on recurring market behaviors. Seasonality in financial markets reflects the idea that certain assets often follow predictable patterns during specific times of the year.