Labor market data can cause significant market movement, especially when results differ from forecasts. Here’s how to leverage it:

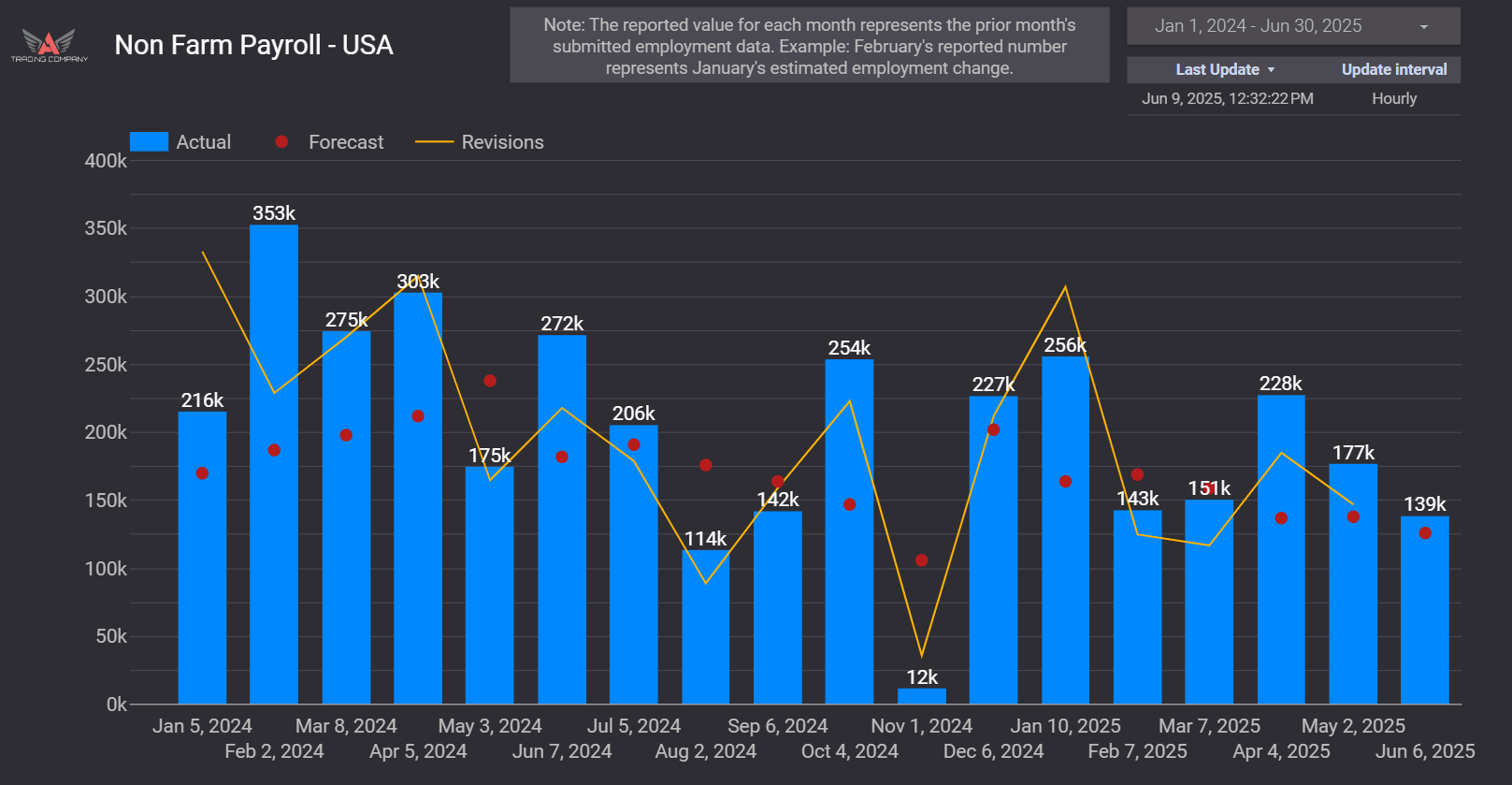

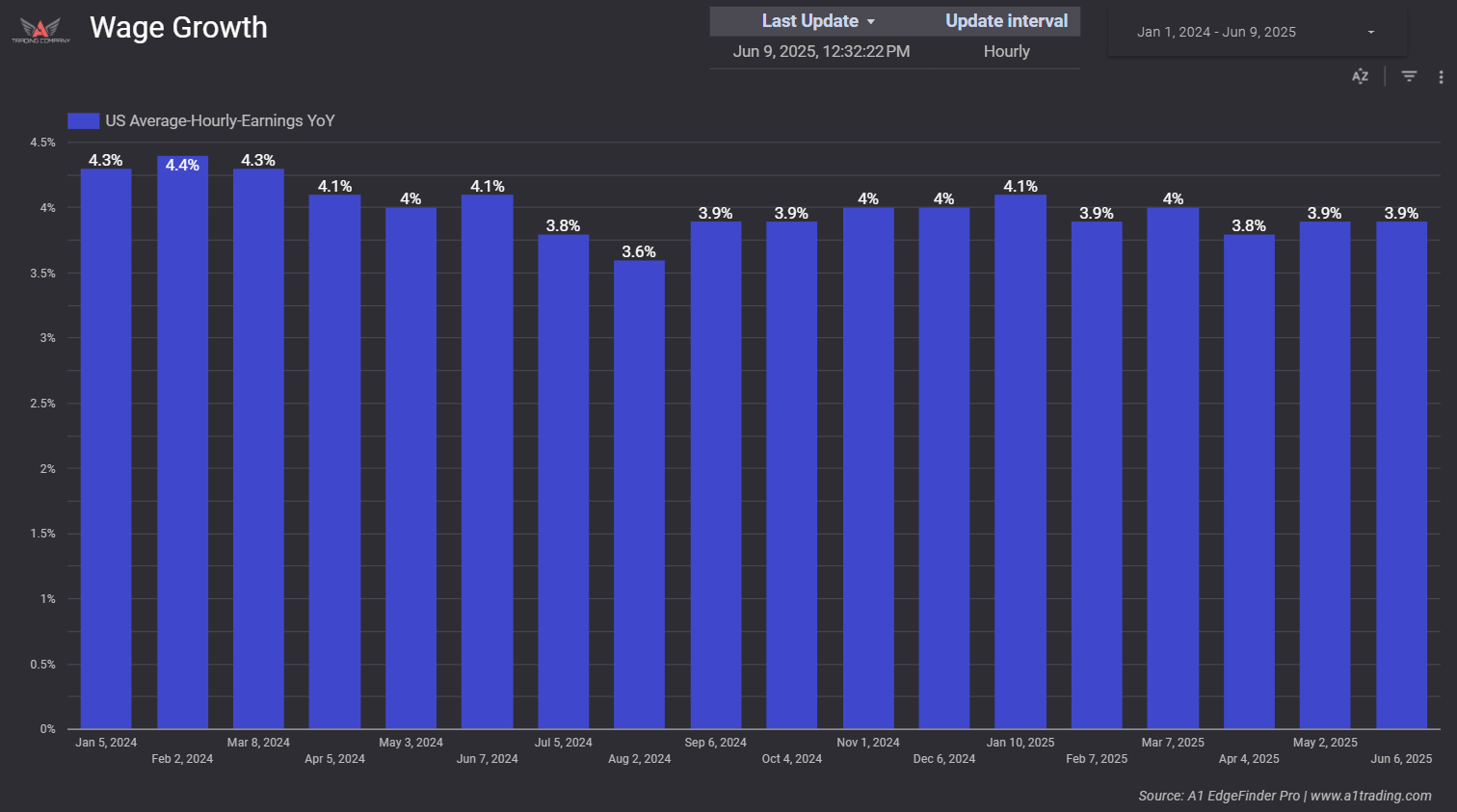

Look for Surprises: Data that significantly exceeds or falls short of expectations can prompt big market reactions. For example, if NFP shows unexpectedly high job gains, it often boosts the currency and could signal strength in related stock markets.

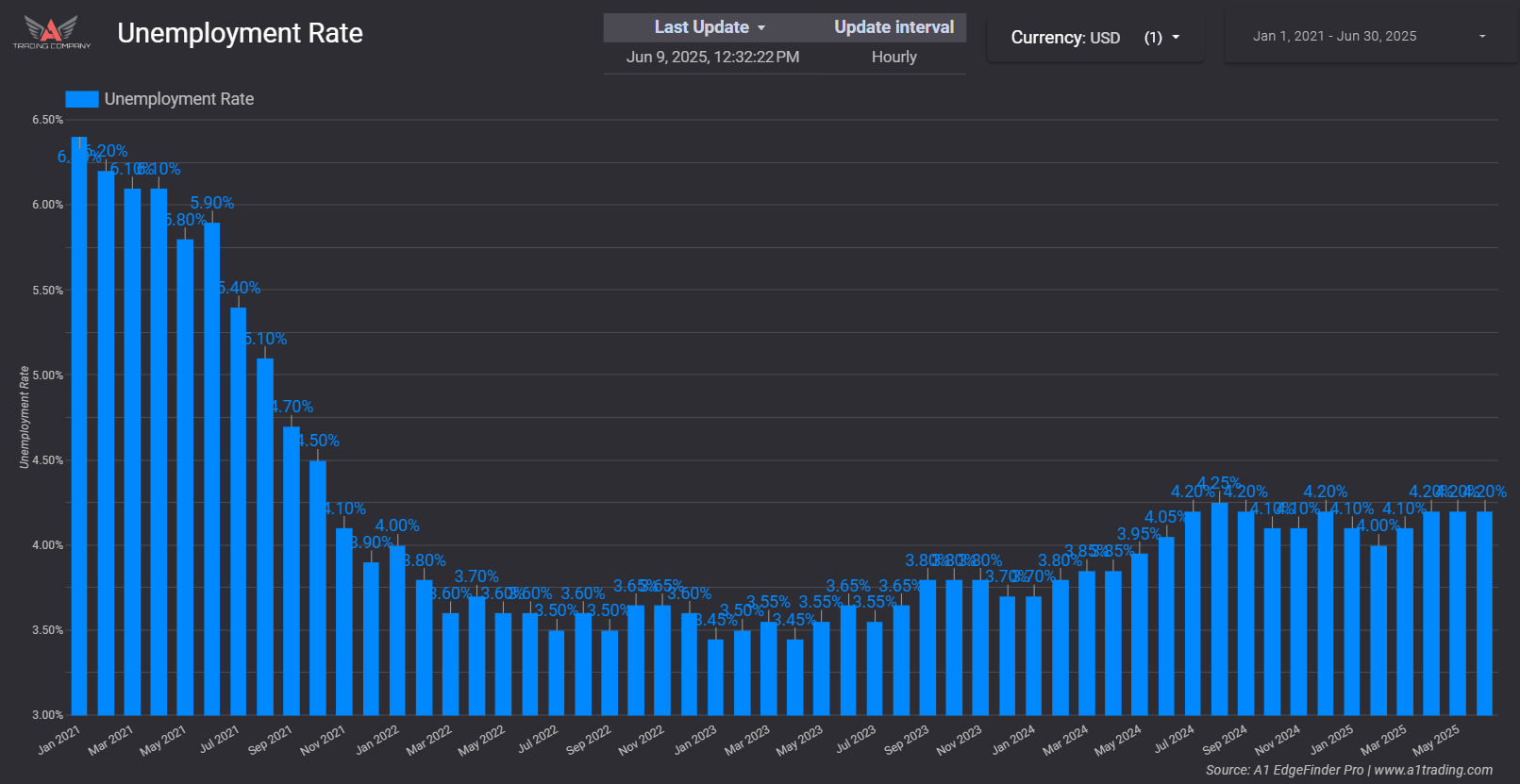

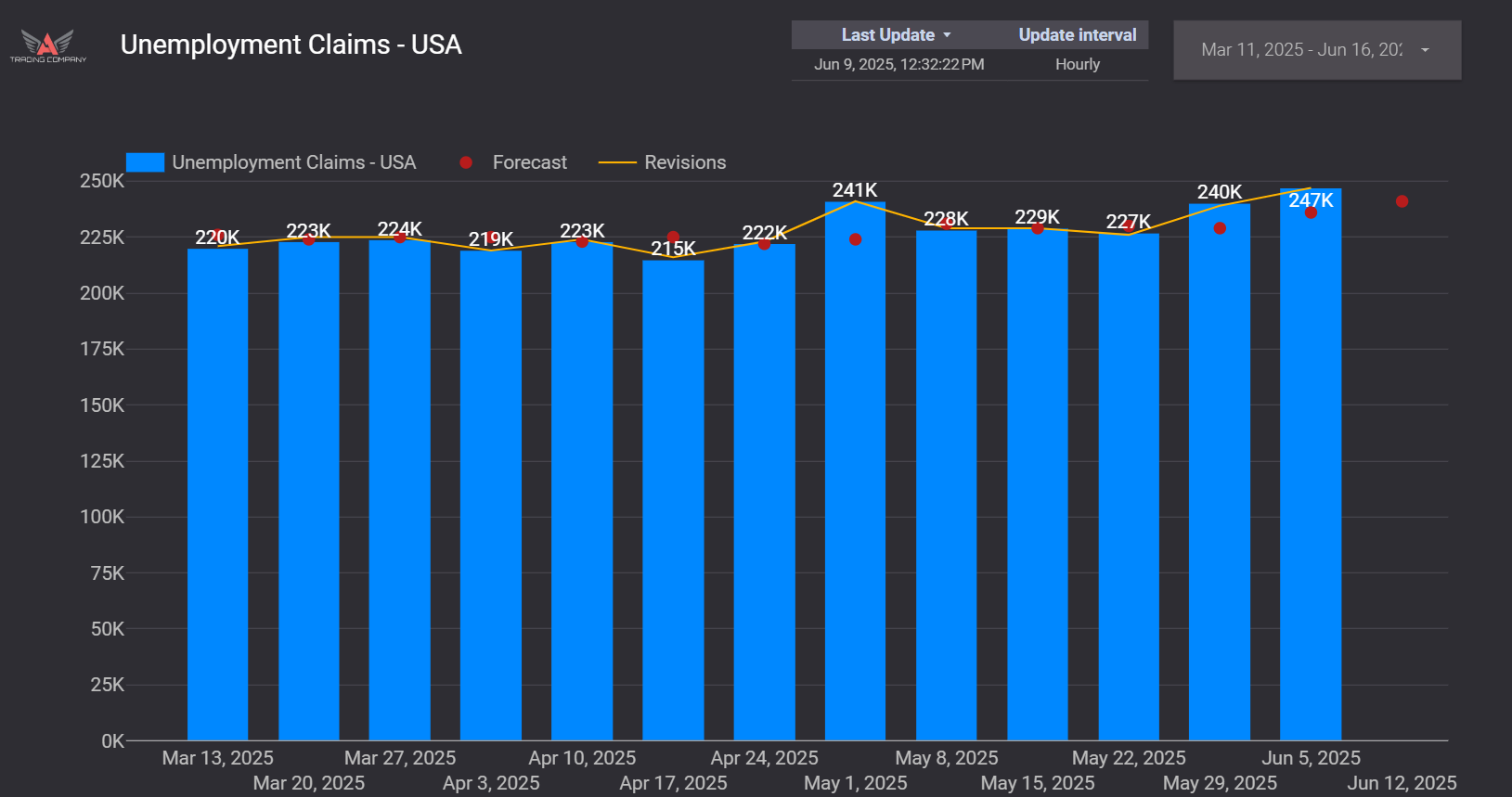

Assess Unemployment Trends: Declining unemployment can signal a stable economy, potentially strengthening the currency. Conversely, an increase in unemployment may weaken currency strength, which can influence sell or hold decisions.

Combine with Other Indicators: Labor market data works well alongside GDP and inflation insights, offering a fuller picture of economic health. For example, strong job growth coupled with rising GDP typically reinforces a bullish outlook.