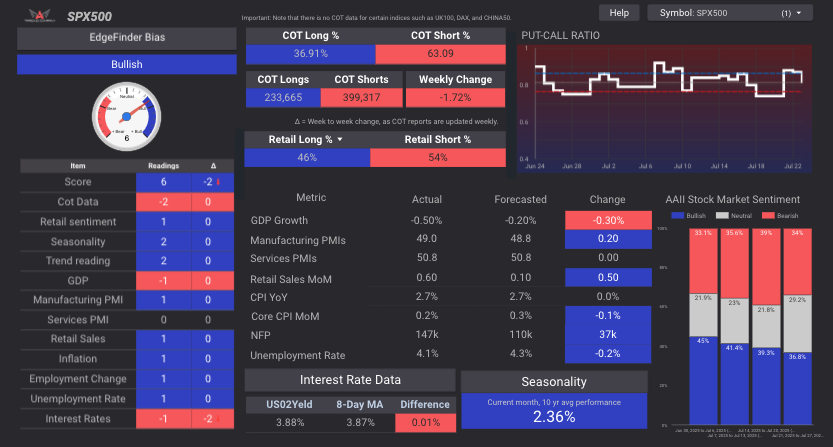

Because the EdgeFinder is not a signal service or a complete trading system, it’s not possible to assign a fixed “accuracy” to the biases it produces. The tool does not predict price action. Instead, it analyzes economic, sentiment, and price data to generate a directional bias based on how those factors have historically influenced the market.

That bias is simply one piece of the puzzle—it’s meant to support your own trading strategy, not replace it. It’s entirely possible for an asset to show a strong bullish or bearish score while price moves in the opposite direction due to technical breakouts, surprise news, or other market-moving events the EdgeFinder can’t account for.

That said, many traders (including our own team) have found that using the EdgeFinder alongside their technical setups helps them spot better opportunities and make more informed decisions.

View their track record here.