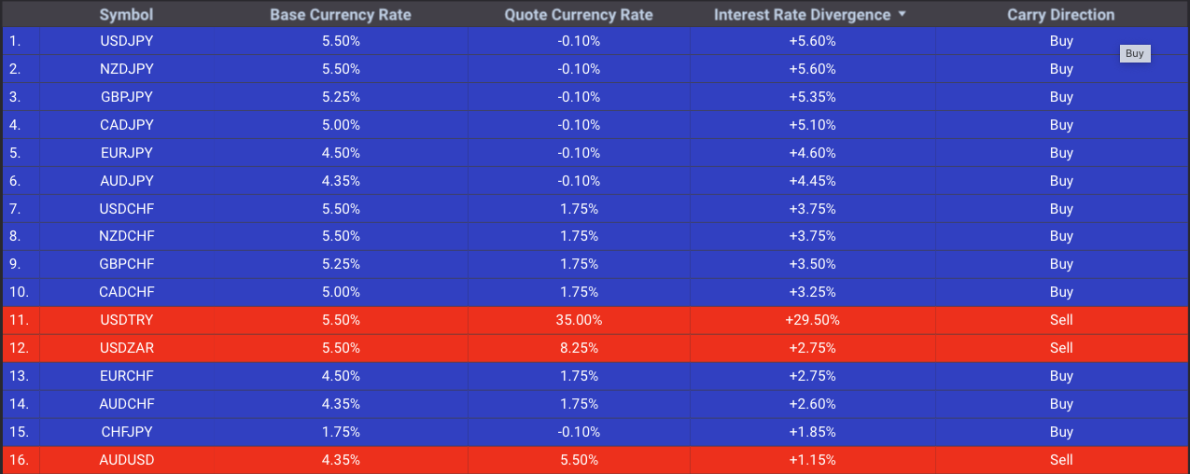

At its core, the carry trade is a strategy that exploits differences in interest rates between two currencies. Since central banks set varying interest rates across countries, some currencies yield higher interest rates while others have low or even negative rates. The carry trade involves borrowing or selling a currency with a relatively low interest rate and using those funds to buy a currency offering a higher interest rate. The trader then earns the interest rate differential as a form of passive income, often referred to as the “carry.”

Example:

Suppose Currency A offers a 5% interest rate, while Currency B offers -1%. By selling Currency B and buying Currency A, a trader earns a 6% interest differential—assuming the exchange rate remains stable or moves in their favor.