Automated trading systems have transformed the financial markets, offering traders tools to manage positions with less manual oversight. Among these, grid trading robots stand out as a systematic way to capitalize on market fluctuations—especially in sideways or ranging markets. Whether you’re new to trading or looking to scale your strategy, grid trading offers a rule-based approach to building and closing positions.

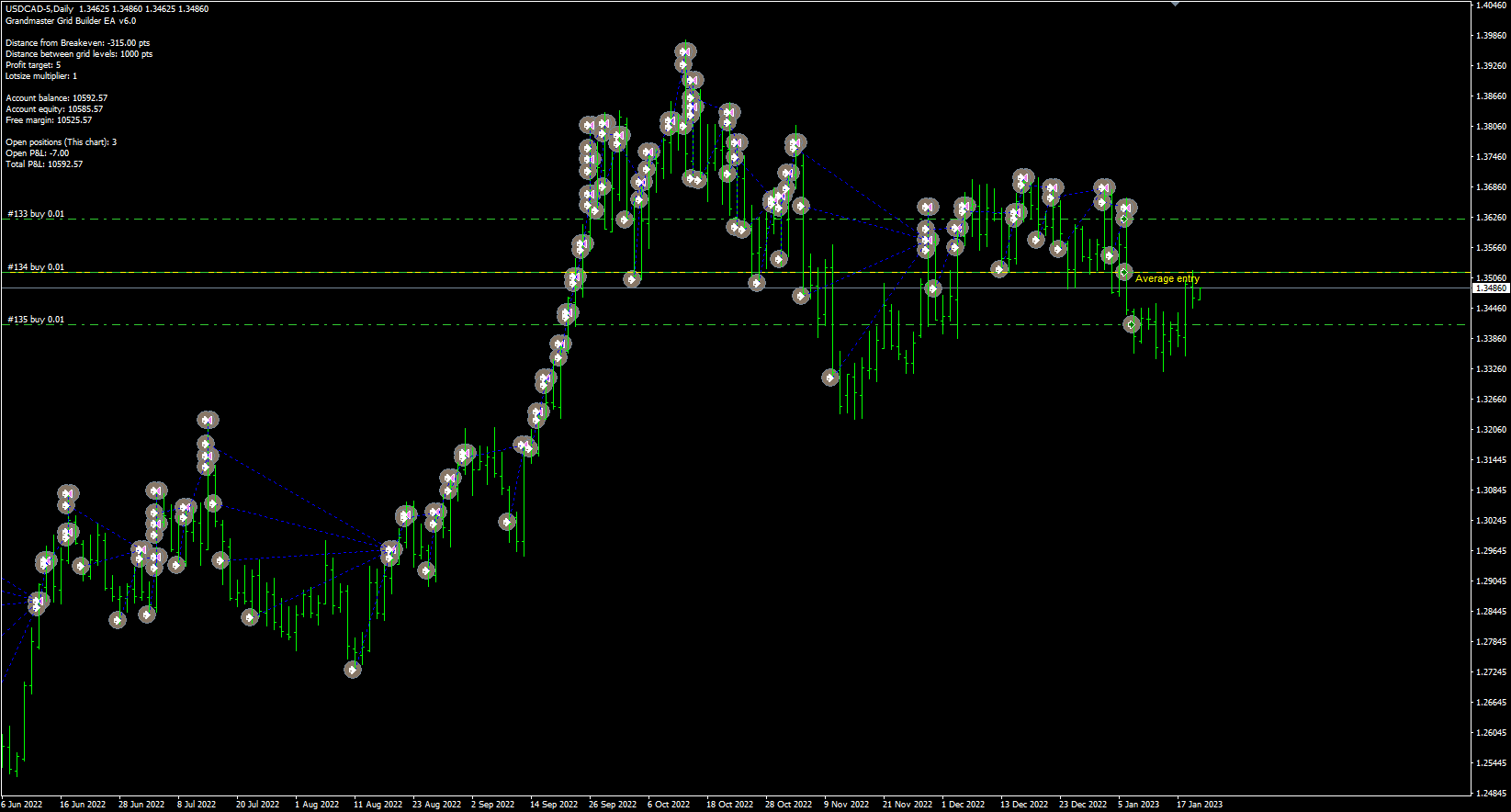

This guide breaks down how grid trading works, its pros and cons, and how tools like LINDEX’s Grandmaster Robot can help automate the entire process.